| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

| CarMax, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ý | No fee required. | |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which the transaction applies: | |||

| (2) | Aggregate number of securities to which the transaction applies: | |||

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of the transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

We also are pleased to furnish proxy materials to shareholders primarily over the Internet.internet. On or about May 7, 2015,4, 2018, we mailed our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report and to vote online. Internet distribution of our proxy materials expedites receipt by shareholders, lowers the cost of the annual shareholders meeting, and conserves natural resources. However, if you would prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice of Internet Availability.

Availability of Proxy Materials.

William R. Tiefel

Chairman

| When: | ||||

| Where: | ||||

Hilton Richmond Hotel, Short Pump 12042 West Broad Street Richmond, VA 23233 | ||||

| Items of Business: | (1) | |||

| To elect the eleven directors named in the proxy statement to our Board of Directors. | ||||

| (2) | To ratify the appointment of KPMG LLP as our independent registered public accounting firm. | |||

| (3) | To vote on an advisory resolution to approve the compensation of our named executive officers. | |||

| (4) | To vote on the shareholder proposal for a report on political contributions, if properly presented at the meeting. | |||

| To transact any other business that may properly come before the annual shareholders meeting or any postponements or adjournments thereof. | ||||

| Who May Vote: | ||||

You may vote if you owned CarMax common stock at the close of business on April | ||||

Senior

TABLE OF CONTENTS |

| COMPENSATION TABLES | ||

PROXY SUMMARY |

2018.

We achieved record revenues and net earnings in fiscal 2015. Annual highlights included the following:

| Market Share Growth | We estimate that our share of the 0- to 10-year old used vehicle market increased almost 7% in our television markets in calendar 2017. |

| Store Growth | We opened |

Revenues/Earnings | We achieved top and bottom-line growth. Net sales and operating revenues increased |

| Units | Total used unit sales increased |

CarMax Auto Finance | CarMax Auto Finance (“CAF”) finished the year with income of |

Share Repurchases | We continued |

Fourteenth Year on Fortune “Best Companies” List | We were named by Fortune magazine as one of its “100 Best Companies to Work For” for the |

|

| |

|

| |

l Majority voting for directors | ||

l Substantial majority of director nominees are independent (9 of 11) | l Proxy access adopted in 2015 | |

l Five new independent directors since 2015 | l Annual “say on pay” vote | |

l Shareholder rights plan expired in 2012 and was not renewed | ||

Where Who May Attend Available at investors.carmax.com Agenda Item Board Recommendation Page of Proxy Statement Election of Eleven Directors FOR each Director nominee Ratification of Auditors Advisory Approval of Executive Compensation Nominee well as all long-term equity grants to Mr. Nash during fiscal 2017. Mr. Nash’s actual total direct compensation for fiscal 2017 equaled $6,344,501. Next Year’s Annual Shareholders Meeting June January CarMax uses a majority vote standard for the election of directors. This means that to be elected in uncontested elections, each nominee must be approved by the affirmative vote of a majority of the votes cast. Annual Meeting of ShareholdersWhenMonday,When Tuesday, June 22, 2015,26, 2018, at 1:00 p.m., Eastern TimeHilton Richmond Hotel, Short Pump12042 West Broad StreetRichmond, VA 23233All shareholders as of the record date may attend the meeting. Record DateApril 17, 201520, 2018Live Audio Webcast Voting Matters and Board Recommendations 1. 6 2. FOR 20 3. FOR 23 Agenda ItemBoard Recommendation Page of Proxy Statement 1. Election of Eleven Directors FOR each Director nominee 6 2. Ratification of Auditors FOR 22 3. Advisory Approval of Executive Compensation FOR 25 4. Shareholder Proposal for a Report on Political Contributions AGAINST 57 2Proposal One:Election of DirectorsWe are asking you to vote “FOR” the following candidates for election to our Board of Directors.Age Director

SinceIndependent Principal Occupation Committee Membership Ronald E. Blaylock 55 2007 Yes Founder and Managing Partner of GenNx360 Capital Partners, a private-equity buyout fund Compensation and Personnel Thomas J. Folliard 50 2006 No President and Chief Executive Officer

of CarMax, Inc.N/A Rakesh Gangwal 61 2011 Yes Former Chief Executive Officer of US Airways Group, Inc. and Worldspan Technologies, Inc., a provider of information technology services to the travel industry Nominating and

Governance

2Table of ContentsNominee Age Director

Since Independent Principal Occupation Expected Committee Membership Peter J. Bensen 55 2018 Yes Retired Chief Administrative Officer and Corporate Executive Vice President and Chief Financial Officer of McDonald's Corporation Audit Ronald E. Blaylock 58 2007 Yes Founder and Managing Partner of GenNx360 Capital Partners, a private-equity buyout fund Compensation and Personnel Sona Chawla 50 2017 Yes Chief Operating Officer and President-Elect of Kohl's Corporation Compensation and Personnel Thomas J. Folliard 53 2006 No Non-Executive Chair of the Board, CarMax, Inc. and Retired President and Chief Executive Officer of CarMax, Inc. N/A Shira Goodman 57 2007 Yes Retired Chief Executive Officer of Staples, Inc. Nominating and Governance Robert J. Hombach 52 2018 Yes Retired Executive Vice President, Chief Financial Officer and Chief Operations Officer of Baxalta Incorporated, a biopharmaceutical company Audit David W. McCreight 55 2018 Yes Retired President of Urban Outfitters, Inc., an international consumer products retailer and wholesaler, and Chief Executive Officer of its Anthropologie Group Audit William D. Nash 49 2016 No President and Chief Executive Officer of CarMax, Inc. N/A Marcella Shinder 51 2015 Yes Global Head of Marketing at WeWork Companies Inc., a technologically driven global provider of shared working spaces Nominating and Governance Mitchell D. Steenrod 51 2011 Yes Senior Vice President and Chief Financial Officer of Pilot Travel Centers LLC, the nation’s largest operator of travel centers and truck stops Audit William R. Tiefel 84 2002 Yes Lead Independent Director of CarMax, Inc., retired Vice Chairman of Marriott International, Inc. and Chairman Emeritus of The Ritz-Carlton Hotel Company, LLC Compensation and Personnel Jeffrey E. Garten 68 2002 Yes Juan Trippe Professor in the Practice of International Trade, Finance and Business at the Yale School of Management and Chairman of Garten Rothkopf, an international consulting firm Nominating and

Governance Shira Goodman 54 2007 Yes President, North American Commercial of Staples, Inc. Compensation and Personnel W. Robert Grafton 74 2003 Yes Retired Managing Partner-Chief Executive, Andersen Worldwide S.C. Audit Edgar H. Grubb 75 2007 Yes Retired Executive Vice President and Chief Financial Officer of Transamerica Corporation, a leading insurance and financial services company Nominating and

Governance Marcella Shinder 48 2015 Yes Chief Marketing Officer of Nielsen N.V., a leading global performance management company Audit Mitchell D. Steenrod 48 2011 Yes Senior Vice President and Chief Financial Officer of Pilot Travel Centers LLC, the nation’s largest operator of travel centers and truck stops Audit Thomas G. Stemberg 66 2003 Yes Managing General Partner of the Highland Consumer Fund at Highland Capital Partners; Founder and Chairman Emeritus of the Board of Staples, Inc. Compensation and Personnel William R. Tiefel 81 2002 Yes Chairman of the Board of CarMax, Inc., retired Vice Chairman of Marriott International, Inc. and Chairman Emeritus of The Ritz-Carlton Hotel Company, LLC Audit  3Proposal Two:Ratification of AuditorsWe are asking you to ratify the appointment by the Audit Committee of KPMG LLP (“KPMG”) as our independent auditors for fiscal

3Proposal Two:Ratification of AuditorsWe are asking you to ratify the appointment by the Audit Committee of KPMG LLP (“KPMG”) as our independent auditors for fiscal 2016.2019. The following table summarizes the fees billed by KPMG for fiscal 20152018 and 2014. Audit Fees Audit-Related

FeesTax Fees Other Fees Total Fees Fiscal 2015 $1,459,600 $387,000 $346,900 $465,000 $2,658,500 Fiscal 2014 $1,034,500 $437,800 $109,000 - $1,581,300

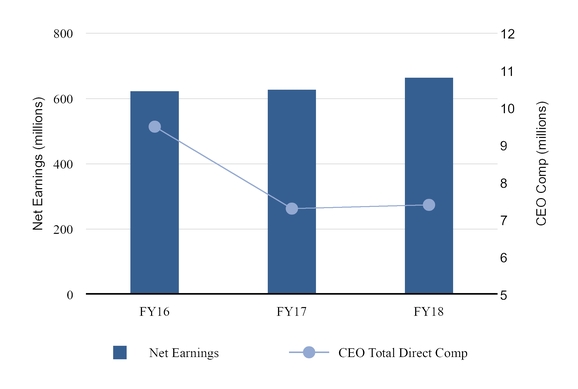

2017.3Audit Fees Audit-Related Fees Tax Fees Total Fees Fiscal 2018 $1,969,125 $547,000 $130,002 $2,646,127 Fiscal 2017 $1,726,450 $440,000 $155,350 $2,321,800 Proposal Three:Executive CompensationWe are asking you to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement. At our last two annual shareholders meetings, a significant majority of our shareholders supported our executive compensation program, with more than 91%87% and 92%96% of votes cast in 20142017 and 2013,2016, respectively, voting in favor of our program.We strivedesign our compensation plans to tie pay to performance. The following chart illustrates the relationship over the last three fiscal years between our net earnings and the total direct compensation (base salary, annual incentive bonus and long-term equity grants) paid to our Chief Executive Officer (“CEO”),. The total direct compensation shown below for fiscal 2016 is the total direct compensation paid to our former CEO, Mr. Folliard. For purposes of this comparison, the fiscal 2017 compensation below represents the annual base salary and target annual incentive bonus approved for Mr. Nash on his promotion in September 2016, as reported in our proxy statements.Net Earnings and CEO Total Direct Compensation

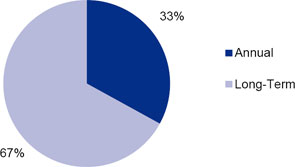

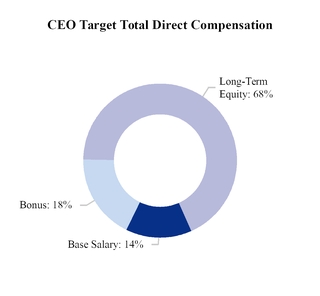

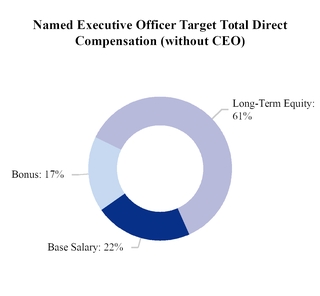

We also strive to align the interests of our executives with the interests of our shareholders. The following charts illustrate how most of our CEO’s total direct compensation paid in fiscal 2015 was composed of our annual incentive bonus and long-term equity and how most of that performance-based compensation was tied to our long-term performance.CEO Total Direct CompensationCEO Performance-Based Compensation

You will find additional information on our executive compensation program beginning on page

You will find additional information on our executive compensation program beginning on page 24. This information includes26.4Proposal Four:Shareholder Proposal for a chartReport on page 25 describing changes we madePolitical ContributionsThe Board recommends a vote against this proposal, which would require that CarMax make certain political contribution disclosures. CarMax’s political contributions, while purposeful, are limited in amount; subject to the compensationCarMax Corporate Political Contribution Policy and Board oversight; and already disclosed as required under state contribution disclosure laws. Shareholders did not approve almost identical proposals at the 2016 and 2017 annual shareholders meetings. The Board continues to believe that adoption of our named executive officersthe shareholder proposal is both unnecessary and not in fiscal 2015.

the best interest of shareholders.4Expected Date of 20162019 Annual Shareholders Meeting28, 2016Deadline for Shareholder Proposals8, 201654, 2019 5PROPOSAL ONE: ELECTION OF DIRECTORSWe are asking you to vote for the election of the eleven director nominees listed on the following pages. Our Board has nominated these individuals at the recommendation of our independent Nominating and Governance Committee. The Committee based its recommendation on, among other things, the results of an annual Board and peer evaluation

5PROPOSAL ONE: ELECTION OF DIRECTORSWe are asking you to vote for the election of the eleven director nominees listed on the following pages. Our Board has nominated these individuals at the recommendation of our independent Nominating and Governance Committee. The Committee based its recommendation on, among other things, the results of an annual Board and peer evaluation process. Allprocess, as well as the integrity, experience and skills of each nominee.This year the Board focused on the refreshment and composition of its membership. Of the eleven nominees, eight are current directors who were elected at our 2017 annual shareholders meeting. Three nominees are being voted on by shareholders at our 2014 annual meeting, except Ms. Shinder, whofor the first time. Messrs. Bensen and Hombach joined the Board in April 2015.2018 and Mr. McCreight will join the Board in June 2018 if elected at the annual shareholders meeting.We appointed Messrs. Bensen and Hombach to the Board after conducting an extensive search for directors with, among other qualities, financial expertise and executive experience. Mr. McCreight is nominated for election following an extensive search for a director nominee with, among other qualities, executive retail experience. Each search was led by our Nominating and Governance Committee with the assistance of an outside search firm.In addition to the three new nominees, five directors who were elected at the 2017 annual shareholders meeting are not standing for election at the 2018 annual shareholders meeting. Messrs. Grafton and Grubb, directors since 2003 and 2007, respectively, were not re-nominated to the Board under the terms of our director retirement policy. Mr. Garten, a director since 2002, has decided not to stand for re-election. Mr. Colberg, a director since 2015, was not nominated for re-election in anticipation of a proposed merger between Assurant, Inc., where he is chief executive officer, and The Warranty Group, a current CarMax service provider. John Standley, a director since 2016, retired from the board in January 2018.To ensure a smooth transition for the Board and our new directors, the Board waived the application of our director retirement policy to William Tiefel for one year, as permitted by CarMax’s Corporate Governance Guidelines. If elected to another term at the 2018 annual shareholders meeting, Mr. Tiefel will also continue to serve as the Board’s lead independent director.Our Board is declassified. Accordingly, each director nominee is standing for election to hold office until our 2019 annual meeting of shareholders.Our Board is declassified. This means that each director stands for election for a one-year term every year.We appointed Ms. Shinder to the Board after conducting an extensive search for a director with, among other qualities, digital expertise. The search was led by our Nominating and Governance Committee with the assistance of an outside search firm, which first brought Ms. Shinder to the Committee’s attention.Our Board is declassified. Accordingly, each of our directors is standing for election to hold office until our 2016 annual meeting of shareholders.Each nominee must receive a majority of the votes cast. Each nominee has consented to being named in this proxy statement and to serve if elected. If any nominee is not available to serve—for reasons such as death or disability—your proxy will be voted for a substitute nominee if the Board nominates one.The following pages include information about the nominees. This information includes a summary of the specific experience, qualifications, attributes or skills that led to the conclusion that each person should serve as a CarMax director.The Board recommends a voteFOR each of the nominees. 6

66 PETER J. BENSENMr. Bensen retired from McDonald’s Corporation, following a 20-year career, in 2016. He served as McDonald’s Chief Administrative Officer from 2015 to 2016. Before that he served as McDonald’s Corporate Executive Vice President and Chief Financial Officer from 2008 to 2014, when he was promoted to Corporate Senior Executive Vice President and Chief Financial Officer, a position he held until 2015. Before joining McDonald’s in 1996, Mr. Bensen was a senior manager at Ernst & Young LLP.Director since: 2018Age: 55IndependentOther Current DirectorshipsLamb Weston Holdings, Inc.Other Directorships within Past 5 YearsCatamaran Corporation (2011-2015)QualificationsMr. Bensen’s long-standing service as the chief financial officer, and in other administrative, financial and accounting roles, at a global, iconic company qualify him to serve on our Board. He brings to our Board extensive management experience and financial expertise, as well as his background as a key executive helping to shape McDonald’s strategic response to a changing market environment.

PETER J. BENSENMr. Bensen retired from McDonald’s Corporation, following a 20-year career, in 2016. He served as McDonald’s Chief Administrative Officer from 2015 to 2016. Before that he served as McDonald’s Corporate Executive Vice President and Chief Financial Officer from 2008 to 2014, when he was promoted to Corporate Senior Executive Vice President and Chief Financial Officer, a position he held until 2015. Before joining McDonald’s in 1996, Mr. Bensen was a senior manager at Ernst & Young LLP.Director since: 2018Age: 55IndependentOther Current DirectorshipsLamb Weston Holdings, Inc.Other Directorships within Past 5 YearsCatamaran Corporation (2011-2015)QualificationsMr. Bensen’s long-standing service as the chief financial officer, and in other administrative, financial and accounting roles, at a global, iconic company qualify him to serve on our Board. He brings to our Board extensive management experience and financial expertise, as well as his background as a key executive helping to shape McDonald’s strategic response to a changing market environment.

Ronald E. BlaylockDirector since: 2007Age: 55Independent

Thomas J. FolliardDirector since: 2006Age: 50MR. RONALD E. BLAYLOCKMr. Blaylock is the founder and Managing Partner of GenNx360 Capital Partners, a private-equity buyout fund focused on industrial business-to-business companies. Prior to founding GenNx360 in 2006, Mr. Blaylock was

RONALD E. BLAYLOCKMr. Blaylock is the founder and Managing Partner of GenNx360 Capital Partners, a private-equity buyout fund focused on industrial business-to-business companies. Prior to founding GenNx360 in 2006, Mr. Blaylock was chief executive officerChief Executive Officer of Blaylock & Company, a full-service investment banking firm that he founded in 1993. Previously, Mr. Blaylock held senior management positions with PaineWebber and Citigroup.MR. FOLLIARDhas been the President and Chief Executive Officer of CarMax since 2006. He joined CarMax in 1993 as senior buyer and became director of purchasing in 1994. Mr. Folliard was promoted to vice president of merchandising in 1996, senior vice president of store operations in 2000, executive vice president of store operations in 2001 and president and chief executive officer in 2006.Director since: 2007Age: 58IndependentOther Current DirectorshipsOther Current DirectorshipsRadioPfizer Inc., Urban One, Inc. and W. R. Berkley Corporation.PulteGroup, Inc.Other Directorships within Past 5 YearsOther Directorships within Past 5 YearsNone.None.None.QualificationsQualificationsMr. Blaylock’s experience managing two successful investment enterprises, as well as his considerable finance experience, qualify him to serve on our Board. Mr. Blaylock’s years of relevant experience growing companies and serving on other public company boards enable him to provide additional insight to our Board. 7

7 SONA CHAWLAMs. Chawla is the Chief Operating Officer and President-Elect of Kohl's Corporation, a position she has held since September 2017. Kohl’s has announced that Ms. Chawla will become its President at the conclusion of its annual shareholder meeting on May 16, 2018. Ms. Chawla joined Kohl’s in November 2015, serving as Chief Operating Officer until September 2017. Before joining Kohl’s, Ms. Chawla served at Walgreens as its President of Digital and Chief Marketing Officer from February 2014 to November 2015 and as its President, E-commerce from January 2011 to February 2014. Ms. Chawla has 17 years of experience in digital and retail.Director since: 2017Age: 50IndependentOther Current DirectorshipsNone.Other Directorships within Past 5 YearsExpress, Inc. (2012-2015)QualificationsMs. Chawla’s executive, strategic, operational and digital expertise qualify her to serve on our Board. Her background and operating experience in retail, including e-commerce, omni-channel strategy, store operations, logistics, information and digital technology strengthen the business and strategic insight of our Board.

SONA CHAWLAMs. Chawla is the Chief Operating Officer and President-Elect of Kohl's Corporation, a position she has held since September 2017. Kohl’s has announced that Ms. Chawla will become its President at the conclusion of its annual shareholder meeting on May 16, 2018. Ms. Chawla joined Kohl’s in November 2015, serving as Chief Operating Officer until September 2017. Before joining Kohl’s, Ms. Chawla served at Walgreens as its President of Digital and Chief Marketing Officer from February 2014 to November 2015 and as its President, E-commerce from January 2011 to February 2014. Ms. Chawla has 17 years of experience in digital and retail.Director since: 2017Age: 50IndependentOther Current DirectorshipsNone.Other Directorships within Past 5 YearsExpress, Inc. (2012-2015)QualificationsMs. Chawla’s executive, strategic, operational and digital expertise qualify her to serve on our Board. Her background and operating experience in retail, including e-commerce, omni-channel strategy, store operations, logistics, information and digital technology strengthen the business and strategic insight of our Board. THOMAS J. FOLLIARDMr. Folliard has been the Non-Executive Chair of the Board of CarMax since August 2016. He joined CarMax in 1993 as senior buyer and became Director of Purchasing in 1994. He was promoted to Vice President of Merchandising in 1996, Senior Vice President of Store Operations in 2000 and Executive Vice President of Store Operations in 2001. Mr. Folliard served as President and Chief Executive Officer of CarMax from 2006 to February 2016 and retired as Chief Executive Officer in August 2016.Director since: 2006Age: 53Non-Executive Chair ofthe BoardOther Current DirectorshipsPulteGroup, Inc.Other Directorships within Past 5 YearsDAVIDsTEA, Inc. (2014-2017)QualificationsDuring his ten years as CEO, Mr. Folliard successfully led CarMax through the company’s establishment as a national brand and a time of significant growth, during which its store base and total revenues more than doubled and its net income quadrupled. With his long tenure at CarMax, Mr. Folliard brings to the board significant executive experience and in-depth knowledge of our company and the auto retail industry.��8

THOMAS J. FOLLIARDMr. Folliard has been the Non-Executive Chair of the Board of CarMax since August 2016. He joined CarMax in 1993 as senior buyer and became Director of Purchasing in 1994. He was promoted to Vice President of Merchandising in 1996, Senior Vice President of Store Operations in 2000 and Executive Vice President of Store Operations in 2001. Mr. Folliard served as President and Chief Executive Officer of CarMax from 2006 to February 2016 and retired as Chief Executive Officer in August 2016.Director since: 2006Age: 53Non-Executive Chair ofthe BoardOther Current DirectorshipsPulteGroup, Inc.Other Directorships within Past 5 YearsDAVIDsTEA, Inc. (2014-2017)QualificationsDuring his ten years as CEO, Mr. Folliard successfully led CarMax through the company’s establishment as a national brand and a time of significant growth, during which its store base and total revenues more than doubled and its net income quadrupled. With his long tenure at CarMax, Mr. Folliard brings to the board significant executive experience and in-depth knowledge of our company and the auto retail industry.��8  SHIRA GOODMANMs. Goodman is the retired Chief Executive Officer of Staples, Inc. Ms. Goodman joined Staples in 1992 and held a variety of positions of increasing responsibility in general management, marketing and human resources, including serving as Executive Vice President, Marketing from 2001 to 2009, Executive Vice President, Human Resources from 2009 to 2012, Executive Vice President, Global Growth from 2012 to 2014, President, North American Commercial from 2014 to 2016, President, North American Operations from February to June 2016, Interim Chief Executive Officer from June to September 2016, and Chief Executive Officer from September 2016 to January 2018. From 1986 to 1992, Ms. Goodman worked at Bain & Company in project design, client relationships and case team management and helped develop the initial business plan for the Staples B2B delivery service.Director since: 2007Age: 57IndependentOther Current DirectorshipsNominated to serve as a director of Henry Schein, Inc. if approved by shareholders at their annual meeting on May 31, 2018.Other Directorships within Past 5 YearsStaples, Inc.QualificationsMs. Goodman has proven business acumen, having served as the chief executive and in various other leadership positions at an internationally renowned retailer. Ms. Goodman’s experiences in operations, retail marketing, sales force management, human resources, and business growth at Staples all qualify her to serve on our Board.

SHIRA GOODMANMs. Goodman is the retired Chief Executive Officer of Staples, Inc. Ms. Goodman joined Staples in 1992 and held a variety of positions of increasing responsibility in general management, marketing and human resources, including serving as Executive Vice President, Marketing from 2001 to 2009, Executive Vice President, Human Resources from 2009 to 2012, Executive Vice President, Global Growth from 2012 to 2014, President, North American Commercial from 2014 to 2016, President, North American Operations from February to June 2016, Interim Chief Executive Officer from June to September 2016, and Chief Executive Officer from September 2016 to January 2018. From 1986 to 1992, Ms. Goodman worked at Bain & Company in project design, client relationships and case team management and helped develop the initial business plan for the Staples B2B delivery service.Director since: 2007Age: 57IndependentOther Current DirectorshipsNominated to serve as a director of Henry Schein, Inc. if approved by shareholders at their annual meeting on May 31, 2018.Other Directorships within Past 5 YearsStaples, Inc.QualificationsMs. Goodman has proven business acumen, having served as the chief executive and in various other leadership positions at an internationally renowned retailer. Ms. Goodman’s experiences in operations, retail marketing, sales force management, human resources, and business growth at Staples all qualify her to serve on our Board. ROBERT J. HOMBACHMr. Hombach is the retired Executive Vice President, Chief Financial Officer and Chief Operations Officer of Baxalta, a biopharmaceutical company, a position he held from 2015 until the acquisition of Baxalta by Shire PLC in 2016. Baxalta was spun off from its parent, Baxter, in 2015, where Mr. Hombach served as Vice President and Chief Financial Officer from 2010 until the Baxalta spin off. Mr. Hombach began his career at Baxter, a global healthcare company, in 1989 and served in a number of roles there, including as Vice President of Finance EMEA from 2004 to 2007 and Treasurer from 2007 to 2010.Director since: 2018Age: 52IndependentOther Current DirectorshipsBioMarin Pharmaceutical Inc.Other Directorships within Past 5 YearsNone.QualificationsMr. Hombach’s considerable executive and financial experience qualify him to serve on our Board. His background as an executive at large, multi-national corporations undertaking complex strategic and transactional transitions, in addition to his operational and financial expertise, strengthen the business and strategic insight of our Board.

ROBERT J. HOMBACHMr. Hombach is the retired Executive Vice President, Chief Financial Officer and Chief Operations Officer of Baxalta, a biopharmaceutical company, a position he held from 2015 until the acquisition of Baxalta by Shire PLC in 2016. Baxalta was spun off from its parent, Baxter, in 2015, where Mr. Hombach served as Vice President and Chief Financial Officer from 2010 until the Baxalta spin off. Mr. Hombach began his career at Baxter, a global healthcare company, in 1989 and served in a number of roles there, including as Vice President of Finance EMEA from 2004 to 2007 and Treasurer from 2007 to 2010.Director since: 2018Age: 52IndependentOther Current DirectorshipsBioMarin Pharmaceutical Inc.Other Directorships within Past 5 YearsNone.QualificationsMr. Hombach’s considerable executive and financial experience qualify him to serve on our Board. His background as an executive at large, multi-national corporations undertaking complex strategic and transactional transitions, in addition to his operational and financial expertise, strengthen the business and strategic insight of our Board. 9

9 DAVID W. MCCREIGHTMr. McCreight is the retired President of Urban Outfitters, Inc., an international consumer products retailer and wholesaler, and Chief Executive Officer of its Anthropologie Group. Mr. McCreight served as Chief Executive Officer of Anthropologie from 2011 to 2018 and as President of Urban Outfitters from 2016 to 2018. Previously, Mr. McCreight served as President of Under Armour from 2008 until 2010 and he was President, from 2005 to 2008, and Senior Vice President, from 2003 to 2005, of Lands’ End.Director nomineeAge: 55IndependentOther Current DirectorshipsNone.Other Directorships within Past 5 YearsDAVIDsTEA, Inc. (2014-2018)QualificationsMr. McCreight’s extensive experience as a retail executive qualifies him to serve on our Board. His background as a leader at high profile retail brands executing omni-channel strategies in a fast-evolving market environment will allow him to contribute key strategic insights to our Board.

DAVID W. MCCREIGHTMr. McCreight is the retired President of Urban Outfitters, Inc., an international consumer products retailer and wholesaler, and Chief Executive Officer of its Anthropologie Group. Mr. McCreight served as Chief Executive Officer of Anthropologie from 2011 to 2018 and as President of Urban Outfitters from 2016 to 2018. Previously, Mr. McCreight served as President of Under Armour from 2008 until 2010 and he was President, from 2005 to 2008, and Senior Vice President, from 2003 to 2005, of Lands’ End.Director nomineeAge: 55IndependentOther Current DirectorshipsNone.Other Directorships within Past 5 YearsDAVIDsTEA, Inc. (2014-2018)QualificationsMr. McCreight’s extensive experience as a retail executive qualifies him to serve on our Board. His background as a leader at high profile retail brands executing omni-channel strategies in a fast-evolving market environment will allow him to contribute key strategic insights to our Board. WILLIAM D. NASHMr. Nash has been the President and Chief Executive Officer of CarMax since September 2016. He was promoted to President in February 2016. In 2012, he assumed the role of Executive Vice President, Human Resources and Administrative Services, where he oversaw human resources, information technology, procurement, loss prevention, employee health & safety and construction & facilities. In 2011, Mr. Nash was promoted to Senior Vice President, Human Resources and Administrative Services. Previously, he served as Vice President and Senior Vice President of Merchandising, after serving as Vice President of Auction Services. Mr. Nash joined CarMax in 1997 as auction manager.Director since: 2016Age: 49President and ChiefExecutive OfficerOther Current DirectorshipsNone.Other Directorships within Past 5 YearsNone.QualificationsAs the chief executive officer of CarMax, Mr.

WILLIAM D. NASHMr. Nash has been the President and Chief Executive Officer of CarMax since September 2016. He was promoted to President in February 2016. In 2012, he assumed the role of Executive Vice President, Human Resources and Administrative Services, where he oversaw human resources, information technology, procurement, loss prevention, employee health & safety and construction & facilities. In 2011, Mr. Nash was promoted to Senior Vice President, Human Resources and Administrative Services. Previously, he served as Vice President and Senior Vice President of Merchandising, after serving as Vice President of Auction Services. Mr. Nash joined CarMax in 1997 as auction manager.Director since: 2016Age: 49President and ChiefExecutive OfficerOther Current DirectorshipsNone.Other Directorships within Past 5 YearsNone.QualificationsAs the chief executive officer of CarMax, Mr. FolliardNash leads the Company’s day-to-day operations and is responsible for establishing and executing the Company’s strategic plans. His significant experience in the auto retail industry, his tenure with CarMax and his motivational leadership of more than 22,00025,000 CarMax associates qualify him to serve on our Board.7

Rakesh GangwalDirector since: 2011Age: 61Independent

Jeffrey E. GartenDirector since: 2002Age: 68IndependentMR. GANGWAL is the former Chief Executive Officer of US Airways Group, Inc. and Worldspan Technologies, Inc. From 2003 to 2007, Mr. Gangwal served as chairman, president and chief executive officer of Worldspan Technologies, Inc., a provider of travel and information technology services to the travel and transportation industry. From 2002 to 2003, he was involved in various personal business endeavors, including private equity and consulting projects. From 1998 until his resignation in 2001, Mr. Gangwal served as president and chief executive officer of US Airways Group, Inc. and US Airways, Inc. and from 1996 to 1998, he was the president and chief operating officer of US Airways Group. He is a co-founder of IndiGo, India’s largest low-fare airline.MR. GARTENhas been the Juan Trippe Professor in the Practice of International Trade, Finance and Business at the Yale School of Management since 2005 and chairman of Garten Rothkopf, an international consulting firm, since 2005. He was the Dean of the Yale School of Management from 1995 to 2005. He was the United States Undersecretary of Commerce for International Trade from 1993 to 1995 and previously spent 13 years in investment banking with Lehman Brothers and Blackstone Group. He is a member of the board of overseers of the International Rescue Committee.Other Current DirectorshipsOther Current DirectorshipsOffice Depot, Inc.Aetna Inc. and certain mutual funds of Credit Suisse Asset Management.Other Directorships within Past 5 YearsOther Directorships within Past 5 YearsPetSmart, Inc. (2005-2015) and OfficeMax Incorporated (1998-2013).Served on the board of managers of Standard & Poor’s LLC, a division of The McGraw-Hill Companies (2012-2015).QualificationsQualificationsMr. Gangwal’s experience as a chief executive officer, as well as his extensive background in corporate strategy, operations and technology management, qualify him to serve on our Board. Mr. Gangwal’s service as a board member of publicly traded retail companies further qualifies him to serve on our Board.Mr. Garten’s record as a distinguished business scholar and teacher, as well as his years of government service, investment banking work and service to other significant boards of directors, qualify him to serve on our Board. His appreciation of corporate governance, as well as his tenure as a CarMax Board member, provide wisdom, continuity and value to our Board.

810

Shira GoodmanDirector since: 2007Age: 54Independent

W. Robert GraftonDirector since: 2003Age: 74Independent MS. GOODMANhas been the President, North American Commercial of Staples, Inc., the world’s leading online, delivery and retail seller of business products, since February 2014. In her current position, she leads Staples’ U.S. and Canadian business units that sell and deliver office products and services directly to businesses.  MARCELLA SHINDERMs.

MARCELLA SHINDERMs. Goodman joined Staples in 1992 and has held a variety of positions of increasing responsibility in general management, marketing and human resources, including serving as executive vice president, marketing from 2001 to 2009, executive vice president, human resources from 2009 to 2012, and executive vice president, global growth from 2012 to 2014. From 1986 to 1992, Ms. Goodman worked at Bain & Company in project design, client relationships and case team management.MR. GRAFTON is the retired Managing Partner-Chief Executive, Andersen Worldwide S.C. Andersen Worldwide provided global professional auditing and consulting services through its two service entities, Arthur Andersen and Andersen Consulting. He is a retired certified public accountant and joined Arthur Andersen in 1963. He was elected a member of the Board of Partners, Andersen Worldwide in 1991 and chairman of the Board of Partners in 1994. He served as Managing Partner-Chief Executive from 1997 through 2000.Other Current DirectorshipsOther Current DirectorshipsNone.DiamondRock Hospitality Company (where Mr. Grafton is currently lead director).Other Directorships within Past 5 YearsOther Directorships within Past 5 YearsNone.SRA International, Inc. (2010-2011).QualificationsQualificationsMs. Goodman has proven business acumen, having served in various leadership positions at an internationally renowned retailer. Ms. Goodman’s experiences in retail marketing, sales force management, human resources, and business growth at the world’s largest office products company all qualify her to serve on our Board. In her current position, Ms. Goodman is responsible for leading Staples’ commercial business unit that reported more than $8 billion in sales in its most recent fiscal year.Mr. Grafton’s extensive accounting experience, as well as his roleShinder serves as the chief executiveGlobal Head of an international audit and consulting firm with more than 100,000 employees, qualify himMarketing at WeWork Companies Inc., a technologically driven global provider of shared working spaces. Prior to serve on our Board. His designation as an “audit committee financial expert” and his years of service as our Audit Committee chairman provide significant and consistent leadership.9

Edgar H. GrubbDirector since: 2007Age: 75Independent

Marcellajoining WeWork, Ms. ShinderDirector since: 2015Age: 48IndependentMR. GRUBB is the retired Executive Vice President and was Chief FinancialMarketing Officer of Transamerica Corporation,at WorkMarket, a leading insurance and financial services company. He joined Transamerica in 1989, became executive vice president in 1993 and retired in 1999. From 1986 to 1989, heprovider of advanced labor automation technology, from May 2016 until March 2018. Before that, Ms. Shinder was the senior vice president and chief financial officer of Lucky Stores, Inc.MS. SHINDERis the Chief Marketing Officer of Nielsen N.V., aHoldings plc, the world’s leading global performance management company.consumer data and information company from 2011 to 2016. Prior to joining Nielsen, N.V. in 2011, Ms. Shinder was with American Express, serving in a variety of executive roles including head of global marketing, head of brandspanning general management and social media, and general manager, small business charge cards,marketing including, most recently, as General Manager of the American Express OPEN. Director since: 2015Age: 51IndependentOther Current DirectorshipsOther Current DirectorshipsNone.CSAA Insurance Group, an AAA affiliate providing auto and property coverage to AAA members in 23 states (where Mr. Grubb is a former chairman of the board) and Auto Club Partners, Inc., an affiliation of ten AAA clubs in the United States.None.Other Directorships within Past 5 YearsOther Directorships within Past 5 YearsNone.None.None.QualificationsQualificationsWith extensive experienceMs. Shinder’s experiences as the chief financial officer of a public company, Mr. Grubb provides CarMax with his comprehensive understanding of the complex financial and operational issues that public companies confront. His financial acumen, as well as his demonstrated leadership capabilities, qualify him to serve on our Board.Ms. Shinder’s experience as the chieflead marketing officer of innovative venture capital backed technology companies, as a senior executive at a leading performanceinformation management company, and at a large consumer financial services organization focused on consumer analytics qualifieslending, qualify her to serve on our Board. Further, Ms. Shinder’s deep experience with big data and analytics, machine learning and advanced technologies, cybersecurity, social media, digital marketing and branding enable her to provide additional insight to our Board and its committees.

10

Mitchell D. SteenrodDirector since: 2011Age: 48Independent

Thomas G. StembergDirector since: 2003Age: 66Independent MR. MITCHELL D. STEENRODMr. Steenrod has been the Senior Vice President and Chief Financial Officer of Pilot Travel Centers LLC, the nation’s largest operator of travel centers and truck stops, since 2004. Mr. Steenrod joined Pilot Travel Centers in 2001 as

MITCHELL D. STEENRODMr. Steenrod has been the Senior Vice President and Chief Financial Officer of Pilot Travel Centers LLC, the nation’s largest operator of travel centers and truck stops, since 2004. Mr. Steenrod joined Pilot Travel Centers in 2001 as controllerController and treasurer.Treasurer. In 2004, he was promoted to senior vice presidentSenior Vice President and chief financial officer.Chief Financial Officer. Previously, he spent 12 years with Marathon Oil Company and Marathon Ashland Petroleum LLC in a variety of positions of increasing responsibility in accounting, general management and marketing.MR. STEMBERGis the Managing General Partner of the Highland Consumer Fund at Highland Capital Partners, a venture capital firm. From 2005 to 2007, he acted as the Venture Partner of Highland Capital Partners. Mr. Stemberg is the founder and Chairman Emeritus of the Board of Staples, Inc., the world’s largest office products company and second largest internet retailer. He pioneered the office superstore industry and was chief executive officer of Staples from 1986 to 2002. From 2002 to 2004, Mr. Stemberg served as an executive officer at Staples with the title of Chairman.Director since: 2011Age: 51IndependentOther Current DirectorshipsOther Current DirectorshipsNone.None.Guitar Center, Inc. and lululemon athletica inc. Other Directorships within Past 5 YearsOther Directorships within Past 5 YearsNone.None.PetSmart, Inc. (1988-2015).QualificationsQualificationsMr. Steenrod’s extensive retail industry and operational experience as well as his experience implementing successful growth strategies, including growing Pilot Travel Centers from more than 200 travel centers to over 500650 branded locations over a span of 1016 years, qualify him to serve on our Board. Additionally, Mr. Steenrod’s extensive financial and accounting experience, including his years of experience as a chief financial officer, strengthens our Board through his understanding of accounting principles, financial reporting rules and regulations, and internal controls.Mr. Stemberg’s creation and development of the world’s leading office products company, a “big-box” retailer that experienced significant growth and profitability under Mr. Stemberg’s leadership, provides meaningful insight and knowledge to CarMax. His prior chief executive experience, his board service with various growth retailers, and his current retail-focused venture capital work provide a deep understanding of the retail industry and qualify him to serve on our Board.

|

|

| WILLIAM R. TIEFEL Mr. Tiefel is Lead Independent Director of CarMax and served as Chair of the Board |

Director since: 2002 Age: 84 Lead Independent Director | |

Other Current Directorships None. | |

Other Directorships within Past 5 Years None. | |

Qualifications | |

Mr. Tiefel’s vast leadership experience with a customer-focused, service-oriented lodging and hospitality enterprise | |

CORPORATE GOVERNANCE |

| ||

| Five of our 9 independent director nominees have | the chair. As part of its commitment to | |

| |

| Bylaws | Our bylaws regulate the corporate affairs of CarMax. They include provisions relating to shareholder meetings, voting, |

Corporate Governance Guidelines | Our |

Code of Business Conduct | Our code of business conduct is Any amendment to, or waiver from, a provision of this code for our directors or executive officers will be promptly disclosed under the “Corporate Governance” link at investors.carmax.com. |

| ▪ | Ms. Goodman |

| ▪ |

| ▪ | Mr. Garten |

| Our Board periodically reviews this structure and |

Our Board recognizes that, depending on the circumstances, a different leadership model might be appropriate. The Board has no fixed policy on whether the roles of chairmanchair and CEO should be separate or combined, which maintains flexibility based on CarMax’s needs and the Board’s assessment of the Company’s leadership. Our corporate governance guidelines do provide that the Board appoint a lead independent director in the event the CEO is elected chairman,chair or the Board will appoint a lead independent director to serve in accordance with the Company’s Lead Independent Director Charter.

chair otherwise does not qualify as independent.

| Each committee is composed solely of independent directors. | In addition, all members of the Compensation and Personnel Committee qualify as “outside directors” within the meaning of Section 162(m) of the Internal Revenue Code and “non-employee directors” as defined by Rule 16b-3 under the Securities Exchange Act of 1934. Each committee has a charter that describes the committee’s responsibilities. These charters are available under the “Corporate Governance” link at investors.carmax.com or upon written request to our Corporate |

| |||||

| Committee | Current Members | Expected Members After the Annual Shareholders Meeting | Responsibilities | ||

| Audit | Mitchell D. Steenrod

(Chair) Peter J. Bensen Sona Chawla Robert J. Hombach Marcella Shinder | Mitchell D. Steenrod (Chair) Peter J. Bensen Robert J. Hombach David W. McCreight | The Audit Committee assists in the Board’s oversight of: § the integrity of our financial statements; § our compliance with legal and regulatory requirements; § the independent auditors’ qualifications, performance and independence; and § the performance of our internal audit function. The Audit Committee retains and approves all fees paid to the independent auditors, who report directly to the Committee. Each member of the Audit Committee is financially literate, with The Audit Committee’s report to shareholders can be found on page | ||

Compensation and Personnel |

Ronald E. Blaylock (Chair) W. Robert Grafton Shira Goodman William R. Tiefel | Ronald E. Blaylock (Chair) Sona Chawla William R. Tiefel | The Compensation and Personnel Committee assists in the Board’s oversight of: § our executive compensation philosophy; § our executive and director compensation programs, including related risks; § salaries, short- and long-term incentives and other benefits and perquisites for our CEO and other executive officers, including any severance agreements; and § the administration of our incentive compensation plans and all equity-based plans. The Compensation and Personnel Committee has sole authority to retain and terminate its independent compensation consultant, as well as to approve the consultant’s fees. The Compensation and Personnel Committee’s report to shareholders can be found on page | ||

Nominating and Governance | Alan B. Colberg (Chair) Edgar H. Grubb

Jeffrey E. Garten | Shira Goodman (Chair) Marcella Shinder | The Nominating and Governance Committee assists in the Board’s oversight of: § Board organization and membership, including by identifying individuals qualified to become members of the Board, considering director nominees submitted by shareholders, and recommending director nominees to the Board; § management succession planning, including for our CEO; and | ||

§ our corporate governance guidelines. |

In addition, our non-management directors meet in executive session, also without management present, at least once during each regularly scheduled Board meeting. As chair, Mr. Folliard presides over these executive sessions. Shareholders may send their recommendations for director candidates to the attention of our Corporate Secretary at CarMax, Inc., 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238. 66. the recently added directors and the new director nominee are independent and highly qualified to serve on the Board. Other Processes that Support The Board oversees other processes that are not intended primarily to support enterprise risk management, but that assist the Company in identifying and controlling risk. These processes include our compliance and ethics program, our internal audit function, pre-filing review of SEC filings by our management-level disclosure committee, and the work of our independent auditors. 2018. In this context, the Audit Committee has met and held discussions with management, KPMG and the Company’s internal auditors, meeting Board and Committee MeetingsDuring fiscal 2015,2018, our Board met sevenfour times and our Board committees met a combined 2422 times. Each incumbent director attended 85%90% or more of the total number of meetings of the Board and the committees on which he or she served. The average attendance of all of our incumbent directors in fiscal 20152018 was 97%99%. We expect our directors to attend the annual meeting of shareholders and all of our incumbent directors who were directors at the time of the 2014 annual meeting of shareholders did so.16Our independent directors meet in executive session, without management present, at least once during each regularly scheduled Board meeting. As lead independent chairman,director, Mr. Tiefel presides over these executive sessions.The table below lists the number of Board and committee meetings in fiscal 20152018 and discloses each director’s attendance.Director(a) Board Audit Compensation

and PersonnelNominating

and GovernanceRonald E. Blaylock 7 – 5 – Thomas J. Folliard 7 – – – Rakesh Gangwal 6 – – 5 Jeffrey E. Garten 7 – – 5 Shira Goodman 7 – 5 – W. Robert Grafton 7 14* – – Edgar H. Grubb 7 – – 5* Mitchell D. Steenrod 7 14 – – Thomas G. Stemberg 6 – 5* – Beth A. Stewart(b) 2 3 – – William R. Tiefel 6* 13 – – TOTAL MEETINGS 7 14 5 5 Director(a)Board Audit Compensation

and Personnel Nominating

and GovernanceRonald E. Blaylock(b)4 — 6* — Sona Chawla(c)4 10 — — Alan B. Colberg(d)4 2 — 4* Thomas J. Folliard 4* — — — Jeffrey E. Garten(e)4 — — 4 Shira Goodman 4 — 5 — W. Robert Grafton(e)4 — 6* — Edgar H. Grubb(e)4 — — 4* William D. Nash 4 — — — Marcella Shinder 4 12 — — John T. Standley(f)3 10 — — Mitchell D. Steenrod 4 12* — — William R. Tiefel(g)4 — 6 — TOTAL MEETINGS 4 12 6 4 * ChairmanChair(a) Ms. Shinder isMessrs. Bensen, Hombach, and McCreight were not listed in this table because she wasnominated to the Board until after the end of fiscal 2018 and therefore did not a Board member inattend any meetings during fiscal 2015.2018. Rakesh Gangwal did not stand for re-election at our 2017 annual shareholders meeting and did not attend any meetings during fiscal 2018.(b) Mr. Blaylock was named chair of the Compensation and Personnel Committee on October 1, 2017. (c) Ms. Stewart resignedChawla was elected to the Board and appointed to the Audit Committee on April 24, 2017.(d) Mr. Colberg was appointed to the Nominating and Governance Committee on April 24, 2017 and concurrently stepped down from the Audit Committee. He was named chair of the Nominating and Governance Committee on October 1, 2017. Mr. Colberg is not standing for re-election at the 2018 annual shareholders meeting. (e) Mr. Garten, Mr. Grafton, and Mr. Grubb are not standing for re-election at the 2018 annual shareholders meeting. (f) Mr. Standley retired from the Board effective April 15, 2014.on January 29, 2018 and therefore is not standing for re-election at the 2018 annual shareholders meeting.(g) Mr. Tiefel is lead independent director of the Board. Selection of DirectorsCRITERIAThe Board and the Nominating and Governance Committee believe that the Board should include directors with diverse backgrounds and that directors should have, at a minimum, high integrity, sound judgment and significant experience or skills that will benefit the Company.We believe our Board should include directors with diverse backgrounds. have, at a minimum, high integrity, sound judgment and significant experience or skills that will benefit the Company. In addition, the Committee takes into account a number of factors in assessing director nominees, including the current size of the Board, the particular challenges facing CarMax, the Board’s need for specific skills or perspectives, and the nominee’s character, reputation, experience, independence from management and ability to devote the requisite time.Although we do not have a written policy with respect to the consideration of diversity in identifying director nominees, we consider and value diversity in our director selection process. Our code of business conduct defines diversity as the celebration 17of all people and their individual talents and the embracing of new ideas and new ways of thinking to maximize the potential of the overall organization. Through its consideration of the factors listed above, the Nominating and Governance Committee seeks directors with diverse backgrounds to maximize the potential of the Board. We believe that the diverse backgrounds and experiences of our current directors demonstrate the Committee’s success.

17of all people and their individual talents and the embracing of new ideas and new ways of thinking to maximize the potential of the overall organization. Through its consideration of the factors listed above, the Nominating and Governance Committee seeks directors with diverse backgrounds to maximize the potential of the Board. We believe that the diverse backgrounds and experiences of our current directors demonstrate the Committee’s success.

16PROCESSThe Nominating and Governance Committee screens and recommends candidates for nomination by the Board. The Committee may consider input from several sources, including Board members, shareholders, outside search firms, and management. The Committee evaluates candidates in the same manner regardless of the source of the recommendation, using the criteria summarized above.Our bylaws include proxy access provisions, which enable eligible CarMax shareholders to have their own director nominee included in the Company’s proxy materials along with candidates nominated by our Board. Our proxy access right permits an eligible shareholder, or a group of up to 20 shareholders, to nominate and include in CarMax’s proxy materials directors constituting up to 20% of the Board of Directors. To be eligible, the shareholder or shareholder group must have owned 3% or more of our outstanding capital stock continuously for at least three years and satisfy certain notice and other requirements set forth in our bylaws. Shareholders who wish to include director nominations in our proxy statement or nominate directors directly at an annual shareholders meeting must follow the instructions under “Shareholder Proposal Information” on page 59.EVALUATION AND REFRESHMENTIn connection with the annual election of directors and at other times throughout the year, the Nominating and Governance Committee considers whether our Board has the right mix of skills and experience to meet the challenges facing CarMax. One of the processes that assists the Committee in its consideration is our Board’s annual evaluation process. The Board and each of its committees conducts a self-evaluation. In addition, the Chairmanchair, lead independent director and the Committee preside over a peer evaluation process in which each individual director evaluates each other director. The results of these evaluations assist the Committee in determining both whether to nominate incumbent directors for reelection and whether to search for additional directors.As part of its consideration, the Committee reviews both the age and tenure of incumbent directors. TheFollowing the annual meeting, assuming all our director nominees are elected, the average age of our directors is 62will be 56, and their average tenure on our Board is 8.4will be 5.7 years. In fiscal 2015, the Committee recommended, and the Board adopted a mandatory director retirement policy providing that directors may not stand for reelectionre-election after reaching age 76. The Board may waive this limitation in appropriate circumstancescircumstances.Under our retirement policy, Mr. Grafton and there is a limited grandfather periodMr. Grubb were not nominated for re-election at the 2018 annual shareholders meeting. Mr. Colberg and Mr. Garten are also not standing for re-election. Accordingly, the Board has recently added three directors, serving priorMr. Bensen, Ms. Chawla, and Mr. Hombach, and has nominated Mr. McCreight for election to the adoptionBoard. Each of this policy.To ensure a smooth transition for the Board and our new directors, the Board waived the application of the director retirement policy to Mr. Tiefel for one year so he could continue on the Board and as lead independent director.The fresh perspectives and diversity of skills of our new directors, coupled with the institutional knowledge of the continuing independent directors, will provide the Board with ample experience and leadership.18Board’s Role in Succession PlanningThe Board oversees the recruitment, development and retention of executive talent. As part of its oversight, the Board regularly reviews short- and long-term succession plans for the Chief Executive Officer and other senior management positions. In assessing possible CEO candidates, the independent directors identify the skills, experience and other attributes they believe are required to be an effective CEO in light of CarMax’s business strategies, opportunities and challenges.The Board also considers its own succession. In doing so, the Nominating and Governance Committee and the Board take into account, among other things, the needs of the Board and the Company in light of the overall composition of the Board with a view to achieving a balance of skills, experience and attributes that would be beneficial to the Board’s oversight role.Board’s Role in Strategic PlanningWhile the formulation and implementation of CarMax’s strategic plan is primarily the responsibility of management, the Board plays an active role with respect to the Company’s strategy. This includes not only monitoring progress made in executing the strategic plan, but also regularly evaluating the strategy in light of evolving operating and economic conditions. The Board carries out its role primarily through regular reviews of the Company’s strategic plan and discussions with management, which include both broad-based presentations and more in-depth analyses and discussions of specific areas of focus. In addition, regular Board meetings throughout the year include presentations and discussions with management on significant initiatives implementing the strategic plan; developments affecting an area of the Company’s business; and on trends, competition, and emerging challenges and opportunities. The Board also reviews the strategic plan, including actions taken and planned to implement the strategy, as part of its review and approval of the annual budget.The Board’s oversight of risk management enhances the directors’ understanding of the risks associated with the Company’s strategic plan and its ability to provide guidance to and oversight of senior management in executing the Company’s strategy.Board’s Role in Risk OversightOur Board dischargesundertakes its responsibility to oversee risks to CarMax through a risk governance framework designed to:§▪ identify critical risks; §▪ allocate responsibilities for overseeing those risks to the Board and its committees; and §▪ evaluate the Company’s risk management processes. The Board does not view risk in isolation. Rather, it considers risks in virtually everyits business decisiondecisions and as part of CarMax’s business strategy. This consideration occurs in the ordinary course of the Board’s business and is not tied to any of the formal processes described below, although it is enhanced by those processes. 19The following table describes the components of CarMax’s risk governance framework.

19The following table describes the components of CarMax’s risk governance framework.17Assignment of Risk Categoriesto Board and its CommitteesThe Board has assigned oversight of certain key risk categories to either the full Board or one of its committees. For each category, management reports regularly to the Board or the assigned committee, as appropriate, describing CarMax’s strategies for monitoring, managing and mitigating risks that fall within that category.Examples of the risk categories assigned to each committee and the full Board are described below. This list is not comprehensive and is subject to change: § Audit Committee: oversees risks related to financial reporting, compliance and ethics, information technology and cybersecurity, and legal and regulatory issues. § Compensation and PersonnelCommittee: Committee: oversees risks related to human resources and compensation practices. § Nominating and GovernanceCommittee: Committee: oversees risks related to government affairs and CarMax’s reputation. § Board: oversees risks related to the economy, competition, finance and strategy. Enterprise Risk Management Risk Committee: We have a management-level Risk Committee, which is chaired by Thomas W. Reedy, our Executive Vice President and Chief Financial Officer (“CFO”), and includes as members more than ten other associates from across CarMax. The Risk Committee meets periodically to identify and discuss the risks facing CarMax. Board Reporting: The Risk Committee delivers biannual reports to the Board identifying the most significant risks facing the Company. Board Oversight: On an annual basis, Mr. Reedy, on behalf of the Risk Committee, discusses our procedures for identifying significant risks with the Audit Committee.

Risk Oversight and Management We believe that our Board leadership structure, discussed in detail beginning on page 14,15, supports the Board’s risk oversight function. Our chair, lead independent chairmandirector and committee chairs set their respective agendas and lead their respective meetings to ensure strong risk oversight, while our CEO and his management team are charged with managing risk.Related Person TransactionsOur Board has adopted a written Related Person Transactions Policy that applies to any transaction in which:§CarMax or one of its affiliates is a participant;§the amount involved exceeds $120,000; and§the related person involved in the transaction (whether a director, executive officer, owner of more than 5% of our common stock, or an immediate family member of any such person) has a direct or indirect material interest.

18

CarMax or one of its affiliates is a participant;Table of Contentsthe amount involved exceeds $120,000; andthe related person involved in the transaction (whether a director, executive officer, owner of more than 5% of our common stock, or an immediate family member of any such person) has a direct or indirect material interest.A copy of our policy is available under the “Corporate Governance” link at investors.carmax.com. The Audit Committee is responsible for applyingoverseeing the Company’s policy and reviewing any related person transaction that is required to be disclosed pursuant to SEC rules.We did not have any related person transactions in fiscal 2015.2018.In reviewing related person transactions, the Audit Committee considers, among other things:§• the related person’s relationship to CarMax;§• the facts and circumstances of the proposed transaction;§the aggregate dollar amount involved in the transaction;§the related person’s interest in the transaction, including his or her position or relationship with, or ownership in, an entity that is a party to, or has an interest in, the transaction; and§the benefits to CarMax of the proposed transaction and, if applicable, the terms and availability of comparable products and services from unrelated third parties.the aggregate dollar amount involved in the transaction;the related person’s interest in the transaction, including his or her position or relationship with, or ownership in, an entity that is a party to, or has an interest in, the transaction; and20the benefits to CarMax of the proposed transaction and, if applicable, the terms and availability of comparable products and services from unrelated third parties.The Audit Committee will approve or ratify a related person transaction only if it determines that: (i) the transaction serves the best interests of CarMax and its shareholders; or (ii) the transaction is on terms reasonably comparable to those that could be obtained in arm’s length dealings with an unrelated third party.We did not have any related person transactions in fiscal 2015.Shareholder Communication with DirectorsShareholders or other interested parties wishing to contact the Board or any individual director may send correspondence to CarMax, Inc., c/o Corporate Secretary, 12800 Tuckahoe Creek Parkway, Richmond, Virginia 23238, or may send an e-mail to chairman@carmax.com,chair@carmax.com, which is monitored by Eric M. Margolin, our Corporate Secretary. Mr. Margolin will forward to the Board or appropriate Board member any correspondence that deals with the functions of the Board or its committees or any other matter that would be of interest to the Board. If the correspondence is unrelated to Board or shareholder matters, it will be forwarded to the appropriate department within the Company for further handling.19 21PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OFTHE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMWe are asking you to ratify the Audit Committee’s appointment of KPMG LLP (“KPMG”) as CarMax’s independent registered public accounting firm for fiscal 2019. KPMG has served as our independent registered public accounting firm continuously since our separation from Circuit City Stores, Inc. (“Circuit City”) in fiscal 2003, and also served as Circuit City’s independent registered public accounting firm from the incorporation of CarMax, Inc. in 1996 through the separation. KPMG has been appointed by the Audit Committee to continue as CarMax’s independent registered public accounting firm for fiscal 2019. The members of the Audit Committee and the Board believe that the continued retention of KPMG to serve as CarMax’s independent registered public accounting firm is in the best interests of CarMax and its shareholders.The Audit Committee is directly responsible for the appointment, compensation, retention, evaluation, and oversight of the independent registered public accounting firm retained to audit CarMax’s financial statements. The Audit Committee is also responsible for the audit fee negotiations associated with CarMax’s retention of KPMG. In accordance with the SEC-mandated rotation of the audit firm’s lead engagement partner, the Audit Committee and its chairperson are directly involved in the selection of KPMG’s lead engagement partner and were directly involved in the selection of KPMG’s current lead engagement partner, whose period of service began in fiscal 2016. Furthermore, in order to ensure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm.Although we are not required to seek shareholder ratification, we are doing so as a matter of good corporate governance. If the shareholders do not ratify the appointment of KPMG, the Audit Committee will reconsider its decision. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that a change would be in the best interests of CarMax and its shareholders.

21PROPOSAL TWO: RATIFICATION OF THE APPOINTMENT OFTHE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMWe are asking you to ratify the Audit Committee’s appointment of KPMG LLP (“KPMG”) as CarMax’s independent registered public accounting firm for fiscal 2019. KPMG has served as our independent registered public accounting firm continuously since our separation from Circuit City Stores, Inc. (“Circuit City”) in fiscal 2003, and also served as Circuit City’s independent registered public accounting firm from the incorporation of CarMax, Inc. in 1996 through the separation. KPMG has been appointed by the Audit Committee to continue as CarMax’s independent registered public accounting firm for fiscal 2019. The members of the Audit Committee and the Board believe that the continued retention of KPMG to serve as CarMax’s independent registered public accounting firm is in the best interests of CarMax and its shareholders.The Audit Committee is directly responsible for the appointment, compensation, retention, evaluation, and oversight of the independent registered public accounting firm retained to audit CarMax’s financial statements. The Audit Committee is also responsible for the audit fee negotiations associated with CarMax’s retention of KPMG. In accordance with the SEC-mandated rotation of the audit firm’s lead engagement partner, the Audit Committee and its chairperson are directly involved in the selection of KPMG’s lead engagement partner and were directly involved in the selection of KPMG’s current lead engagement partner, whose period of service began in fiscal 2016. Furthermore, in order to ensure continuing auditor independence, the Audit Committee periodically considers whether there should be a regular rotation of the independent registered public accounting firm.Although we are not required to seek shareholder ratification, we are doing so as a matter of good corporate governance. If the shareholders do not ratify the appointment of KPMG, the Audit Committee will reconsider its decision. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that a change would be in the best interests of CarMax and its shareholders. KPMG has served as our independent registered public accounting firm since fiscal 2003.We expect that representatives of KPMG will attend the Annual Meeting.annual shareholders meeting. They will be given the opportunity to make a statement if they desire to do so and to respond to appropriate questions.The Board recommends a voteFOR Proposal Two. 22

2220AUDIT COMMITTEE REPORTAUDIT COMMITTEE REPORTThe Audit Committee reports to and acts on behalf of CarMax’s Board of Directors by providing oversight of the integrity of the Company’s financial statements, the Company’s independent and internal auditors, and the Company’s compliance with legal and regulatory requirements. The Audit Committee operates under a written charter adopted by the Board, which is reviewed annually and is available under the “Corporate Governance” link at investors.carmax.com. The members of the Audit Committee meet the independence and financial literacy requirements of the NYSE and the SEC.Management is responsible for the preparation, presentation and integrity of the Company’s financial statements and the establishment of effective internal controlscontrol over financial reporting. KPMG, LLP, the Company’s independent registered public accounting firm, is responsible for auditing those financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and expressing an opinion on the conformity of CarMax’s audited financial statements with generally accepted accounting principles and on the effectiveness of CarMax’s internal controls over financial reporting.1412 times in fiscal 2015. These meetings have included regular private sessions with each of KPMG and the Company’s head of internal audit, as well as regular private sessions with each of the Company’s Chief Financial Officer, Controller, and General Counsel and Chief Compliance Officer. 2018.Management represented to the Committee that the Company’s fiscal 20152018 consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Committee reviewed and discussed the fiscal 20152018 consolidated financial statements with management and KPMG.The Committee has discussed with KPMG the matters required to be discussed by applicable auditing standards, including significant accounting policies and the quality, not just the acceptability, of the accounting principles utilized. The Committee has also received from KPMG the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the Audit Committee regarding independence, and the Audit Committee has discussed with KPMG the firm’s independence. The Audit Committee concluded that KPMG is independent from the Company and management.In reliance on these reviews and discussions, the Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2015,2018, for filing with the SEC.AUDIT COMMITTEEW. Robert Grafton,ChairmanMarcella ShinderMitchell D. Steenrod,William R. TiefelSona ChawlaMarcella Shinder 23

2321AUDITOR FEESAND PRE-APPROVAL POLICYAUDITOR FEES AND PRE-APPROVAL POLICYAuditor Fees and ServicesThe following table sets forth fees billed by KPMG for fiscal 20152018 and 2014. Years Ended February 28 Type of Fee 2015 2014 Audit Fees(a) $ 1,459,600 $ 1,034,500 Audit-Related Fees(b) 387,000 437,800 Tax Fees(c) 346,900 109,000 All Other Fees(d) 465,000 – TOTAL FEES $ 2,658,500 $ 1,581,300 Years Ended February 28 Type of Fee 2018 2017 Audit Fees(a)$ 1,969,125 $ 1,726,450 Audit-Related Fees(b)547,000 440,000 Tax Fees(c)130,002 155,350 TOTAL FEES $ 2,646,127 $ 2,321,800 (a) This category includes fees associated with the annual audit of CarMax’s consolidated financial statements and the audit of CarMax’s internal control over financial reporting. It also includes fees associated with quarterly reviews of CarMax’s unaudited consolidated financial statements. (b) This category includes fees associated with agreed-upon procedures and attestation services related to our asset-backed securitizations. It also includes fees associated with audits of the financial statements of our benefit plans.securitization program.(c) This category includes fees associated with tax compliance, consultation and planning services. (d)This category includes reimbursement of professional and administrative costs associated with a completed informal regulatory inquiry.Approval of Auditor Fees and ServicesThe Audit Committee’s charter provides for pre-approval of audit and non-audit services to be performed by the independent auditors. The Committee typically pre-approves specific types of audit, audit-related and tax services, together with related fee estimates, on an annual basis. The Committee pre-approves all other services on an individual basis throughout the year as the need arises. The Committee has delegated to its chairmanchair the authority to pre-approve independent auditor engagements in an amount not to exceed $50,000 per engagement. Any such pre-approvals are reported to and ratified by the entire Committee at its next regular meeting.All audit, audit-related and tax services in fiscal 20152018 were pre-approved by the Audit Committee or pre-approved by the Chairmanchair pursuant to his delegated authority and subsequently ratified by the Audit Committee. In all cases, the Audit Committee concluded that the provision of such services by KPMG was compatible with the maintenance of KPMG’s independence.

2224PROPOSAL THREE: ADVISORY RESOLUTION TOAPPROVE EXECUTIVE COMPENSATION

54.

2019.

COMPENSATION DISCUSSION AND ANALYSIS |

| William D. Nash | President and Chief Executive Officer. |

| |

| Thomas W. Reedy | Executive Vice President and Chief Financial Officer. Mr. Reedy joined CarMax in 2003 and was promoted to his current position in 2012. |

| William C. Wood | Executive Vice President |

| Edwin J. Hill |

|

| |

Fiscal 2015 was a record year for CarMax. Highlights of the year include the following:

| Market Share Growth | We estimate that our share of the 0- to 10-year old used vehicle market increased almost 7% in our television markets in calendar 2017. |

| Store Growth | We opened |

| We achieved top and bottom-line |

| Units |

| CarMax Auto Finance |

| We continued |

Fourteenth Year on Fortune “Best Companies” List | We were named by Fortune magazine as one of its “100 Best Companies to Work For” for the |

The following chart summarizes the changes we made to the compensation of our named executive officers in fiscal 2015.

| ||

Compensation Category | Changes We Made

| Why We Made These Changes |

Base Salary |

|

|

| named executive officers. |